How do you get around the already existing pending new escrow payment? When we run them with a pending payment already existing, our escrow payments no longer match the bills and when they pay current the

payment split goes crazy as the bills and escrow payment don’t match. Any information will be helpful as this manual process is difficult for us. Thank you.

Tami Ozogar |

Loan Operation unit manager

3152 NYS Route 417; Olean, NY 14760

![]()

From: xxxxxx@marug.simplelists.com <xxxxxx@marug.simplelists.com>

On Behalf Of Andrea Niedzwicki

Sent: Tuesday, July 30, 2024 1:17 PM

To: xxxxxx@marug.simplelists.com

Subject: SilverLake MA-RUG RE: Escrow analysis question

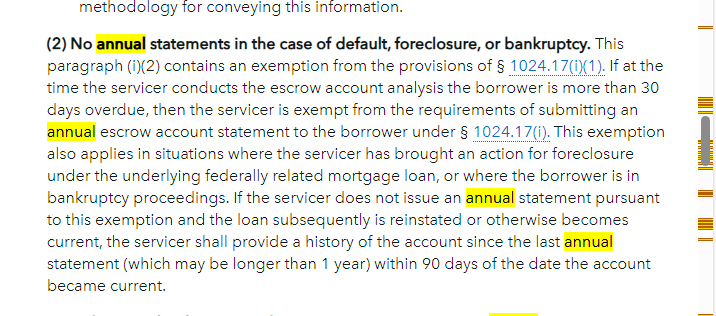

Good afternoon, Even though you are exempt (per the below reg), we choose to run an escrow analysis on past due loans, those in Foreclosure and in Bankruptcy. For

loans in Bankrupcty, when the escrow analsyis is performed, we send the escrow

ZjQcmQRYFpfptBannerStart

|

ZjQcmQRYFpfptBannerEnd

Good afternoon,

Even though you are exempt (per the below reg), we choose to run an escrow analysis on past due loans, those in Foreclosure and in Bankruptcy. For loans in Bankrupcty,

when the escrow analsyis is performed, we send the escrow analysis statement to our attorney so they can prepare the Notice of Payment change and send it to the borrower’s counsel.

If you have any other questions let me know.

Thank you,

Andrea Niedzwicki

Assistant Vice President

Collections Manager

NMLS #712809

Rosedale Federal Savings & Loan Association

9616 A Belair Road

Baltimore, MD 21236

(p) 410-668-4400 ext.344

(f) 410-497-7990

From: Tami Ozogar - Tami.Ozogar at cbna.com (via silverlake list) <xxxxxx@marug.simplelists.com>

Sent: Tuesday, July 30, 2024 9:14 AM

To: xxxxxx@marug.simplelists.com

Subject: SilverLake MA-RUG Escrow analysis question

Good morning,

Can anyone tell me how they are handling escrow analysis on accounts that are past due and already have a pending payment? In the past we have been audited by the CFPB, OCC and HUD and it has been stated

to us that even though you are exempt from sending an escrow analysis statement, you are still required to provide the customer notification of any deficiency that exists in their escrow account each year. This has become very cumbersome and manual for us.

For Bankruptcy loans, we have to strip all of the escrow payments and escrow billing records off the system, create a spreadsheet of these bills, deposit total funds for escrow in bills being stripped out, add a fee record for this deposit amount and then

run the analysis. Collections has to manual split the payments that might come in until loan becomes current. For non-bk loans, we have to run a trial and manually analyze the account to determine if there is a shortfall and then create a deficiency letter

if one exists to the customer. Any other suggestions would be greatly appreciated. Thank you.

§

1024.17 Escrow accounts. | Consumer Financial Protection Bureau (consumerfinance.gov)

Tami Ozogar |

Loan Operation unit manager

3152 NYS Route 417; Olean, NY 14760

![]()

----------

NOTICE: This email may contain material that is confidential, privileged or exempt from disclosure under applicable law. If you are not the intended recipient, including situations where this email was addressed to you in error, please notify the sender immediately

and delete this email. Any use, reliance upon, distribution or forwarding of this information without the sender's express permission is unauthorized and strictly prohibited. In no event shall we accept any responsibility for the loss or misuse of information

including confidential information which is sent to us or our affiliates by email.

----------

This message was sent by a member of the SilverLake MA-RUG ListServ; replying to this email will send your response to all ListServ members.

If you have a question/issue, please check the ListServ archive to see if it has been previously addressed:

Archives

To unsubscribe from this list please goto

Subscription Management

• This email message and any files transmitted with it are confidential/privileged information intended solely for the use of the individual or entity to whom they are addressed. If you are not the intended

recipient, or authorized to receive this for the recipient, you must not disseminate, distribute, copy, disclose, or take any action based on this message or any information herein. If you have received this message in error, please advise the sender immediately

by reply email and delete this message and any attached files from your system. Because the security of email messages cannot be guaranteed, Rosedale Federal recommends that you never disclose your account numbers, social security number, passwords, or PIN

numbers in an email. Thank you for your cooperation.

This message was sent by a member of the SilverLake MA-RUG ListServ; replying to this email will send your response to all ListServ members.

If you have a question/issue, please check the ListServ archive to see if it has been previously addressed:

Archives

To unsubscribe from this list please goto

Subscription Management